Singapore has some of higher a residential property costs regarding the industry. Because of this, really consumers use lenders to really make the acquisition of a house it is possible to. With regards to a mortgage, the genuine cost of the mortgage is the interest. Whatever you together with learn is the fact interest rates are at historical lows, despite your credit rating. For individuals who got aside a loan five, 10 otherwise 15 years back, odds are the interest rate about financing are greater than just what marketplace is currently offering. How can you capture these types of lowest prices whenever you are already using step 1.50%, 2.00% if not step three.00%? The solution is quite simple: believe refinancing your home mortgage.

Refinancing The basics

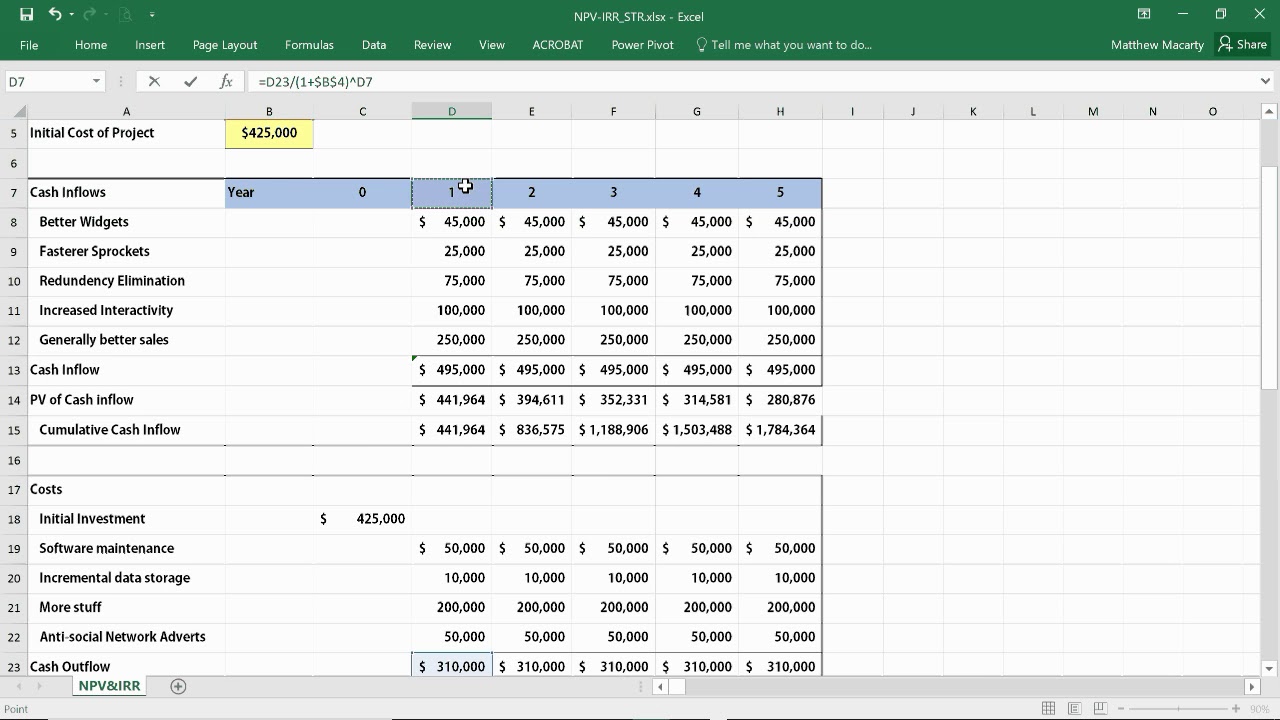

In the their core, refinancing is actually a monetary strategy in which customers pay-off existing highest-focus debt having fun with a new, straight down appeal loans. Observe exactly how so it really works, consider the following analogy.

Why don’t we grab the case of a resident who already provides a good S$500,100 loan from the 1.59% attract for the next 30 years. Every month the guy produces a S$step 1,747 commission towards the bank. Immediately following a persistent look, the new homeowner finds a bank that may let them re-finance that it financing just 0.72% attract. Below chart illustrates just how much help you you will definitely located because of the refinancing the loan. Even although you make the same amount of payment, at that lower rate of interest, it is possible to settle the loan few years shorter!

Given that date stored is an excellent cause to take on refinancing, the genuine worth arises from the lower appeal paid off along side longevity of the mortgage. Inside our prior analogy, i presumed that the citizen went on to invest S$step 1,747 month-to-month no matter if their new financing arrangement only needed monthly premiums off S$1,545. Of several residents commonly opt to create these straight down minimum monthly installments and support the mortgage to own 30 years instead of paying down the mortgage early (once we showed in the previous analogy). The brand new chart less than reveals overall desire money produced below for each and every condition. A-1.59%, 30-12 months financing, will surely cost S$129,020 as a whole notice payments. So it even compares to just S$forty-eight,723 towards a 0.72% home loan over three decades.

By the refinancing, you might pay down debt obligations quicker and invest reduced to the desire across the longevity of the borrowed funds.

There is complete loads of search on the lenders into the Singapore, as well as have learned that the typical rate of interest on the a house financing (repaired price, 30-year) is approximately doing step one.38%. For home buyers that have expert credit scores, interest rates throughout these 30-year fund can be as down. It is surprisingly just like the hypothetical scenario we explained over, and there is numerous offers you might get just before notice prices collect much more than just he has got.

What you should Imagine Prior to Refinancing

Thus refinancing works out an effective option if you can discover a loan provider that will give you less rate of interest. You can find a couple of things you must know before diving during the head basic.

Charges Off Refinancing

Many lenders requires that pay a fee to possess refinancing your loan, such as for example court charges & valuation charges. These types of costs can certainly add up to a sum greater than S$step 3,000. Make sure you are sure that All costs working in an excellent refinance, just like the loan providers was in fact recognized to cover-up costs during the fine print. Check out the the brand new financing agreement very carefully, and get issues, before you sign towards dotted range. Certain banking companies might bring waivers for sure charges to make certain that you might maximise savings off refinancing your house financing.

The break-also Part

Knowing the new charge on the refinancing, you might create an insight into the break-even area. Just as we browsed which have cell phone insurance rates, it crack-also area is a vital build from inside the https://paydayloancolorado.net/yuma/ user funds. The holiday-actually point on people financial purchase is the area where the advantages of a transaction equivalent the expenses. In the case of a mortgage re-finance, this is actually the point where you has actually protected more cash of refinancing than just your paid-in initial fees along the way.

Let’s assume that the lending company issuing this new loan on 0.72% energized the brand new homeowner S$dos,000 inside refinancing fees. Just like the citizen is actually saving S$202 monthly to your money, it might need 10 days to break-actually about exchange.

Since the resident attacks the holiday-actually section, he could be saving $202 per month to the their property loan can cost you. In this situation, refinancing try a very good idea because break-even part was below per year away. Sometimes, even in the event your split-actually section is actually four or ten years aside it could be a good notion.

Conclusions

With all of this article in your mind, youre now willing to begin searching for less focus rate on your home loan. Remain checking ValueChampion to have status into the home loan prices into the Singapore, all round credit environment, and you may suggestions for and work out your hard earned dollars go farther.

Duckju (DJ) ‘s the inventor and you can President regarding ValueChampion. He discusses the fresh monetary characteristics industry, user financing situations, cost management and you will purchasing. He previously spent some time working in the hedge loans like Tiger China and you may Cadian Resource. The guy graduated of Yale School that have an excellent Bachelor regarding Arts knowledge when you look at the Economics which have celebrates, Magna Jizz Laude. Their works might have been checked towards major globally news particularly CNBC, Bloomberg, CNN, the newest Straits Moments, Now and more.