Request because of the current email address

1. Customer’s root percentage authorization otherwise software nevertheless needed. The newest client’s consent required by 1041.8(c) is actually introduction in order to, rather than unlike, people independent payment agreement otherwise instrument expected to be purchased from the consumer not as much as appropriate guidelines.

1. Standard. Part 1041.8(c)(2)(i) kits forward the entire demands you to, to possess purposes of this new exception to this rule inside 1041.8(c), this date, matter, and you can percentage route of every more fee import have to be subscribed by user, at the mercy of a finite exemption when you look at the 1041.8(c)(2)(iii) for commission transmits entirely to gather a belated commission otherwise returned product fee. Appropriately, into exclusion to make use of to an additional percentage transfer, the brand new transfer’s certain day, amount, and you may percentage route need to be as part of the closed authorization acquired in the individual below 1041.8(c)(3)(iii). To possess some tips on the prerequisites and you will conditions that use whenever obtaining the newest consumer’s finalized consent, come across 1041.8(c)(3)(iii) and you will associated remarks.

Certain date

dos. The requirement your certain day of any most payment import be approved by the user try met in the event your user authorizes new week, day, and you can year of each and every import.

step 3. Amount larger than certain amoun t. This new exclusion for the 1041.8(c)(2) does not apply in case your lender starts an installment transfer to own a cost larger than the amount authorized by the individual. Correctly, such a transfer carry out violate the brand new ban on more percentage transmits lower than 1041.8(b).

cuatro. Less. A repayment import started pursuant to http://www.paydayloanalabama.com/hanover 1041.8(c) is set up on certain amount approved by the individual if the their count is equivalent to or smaller compared to the newest licensed count.

step one. General. In the event the a loan provider get the newest client’s authorization so you’re able to initiate a payment transfer entirely to gather a late percentage otherwise came back item commission in accordance with the conditions and you may standards under 1041.8(c)(2)(iii), the overall specifications inside the 1041.8(c)(2) the consumer approve this big date and number of for every single extra commission import doesn’t have to be found.

2. Highest amount. The necessity that the consumer’s finalized consent are an announcement that determine the best amount that is certainly billed having a belated percentage otherwise returned goods fee is actually fulfilled, such as for instance, when your report determine the maximum amount permitted within the mortgage agreement having a covered financing.

step three. Varying fee numbers. When the a charge amount can vary as a result of the left financing harmony or other affairs, the rule necessitates the financial to visualize the standards one to result regarding the higher count you are able to in the figuring the desired number.

1. General. 8(c)(3)(ii) in order to consult a consumer’s authorization to your or following day one the lender gets the individual legal rights observe necessary for 1041.9(c). To your exemption when you look at the 1041.8(c) to put on, but not, new client’s closed consent have to be obtained zero earlier than the newest go out about what an individual is recognized as having gotten the newest consumer legal rights see, because specified into the 1041.8(c)(3)(iii).

2. Different choices. Absolutely nothing into the 1041.8(c)(3)(ii) forbids a lender off taking different alternatives into the consumer to help you imagine with respect to the day, number, or fee station of each and every most commission import for which the fresh financial is actually requesting consent. Likewise, if a customers declines a request, absolutely nothing in the 1041.8(c)(3)(ii) prohibits a loan provider from making a take-upwards demand giving a new gang of words for the individual to adopt. Such, whether your consumer refuses a primary consult so you’re able to approve a few recurring commission transmits getting a specific matter, the financial institution could make a follow-right up request the consumer to help you authorize around three repeated fee transmits to have a lot less.

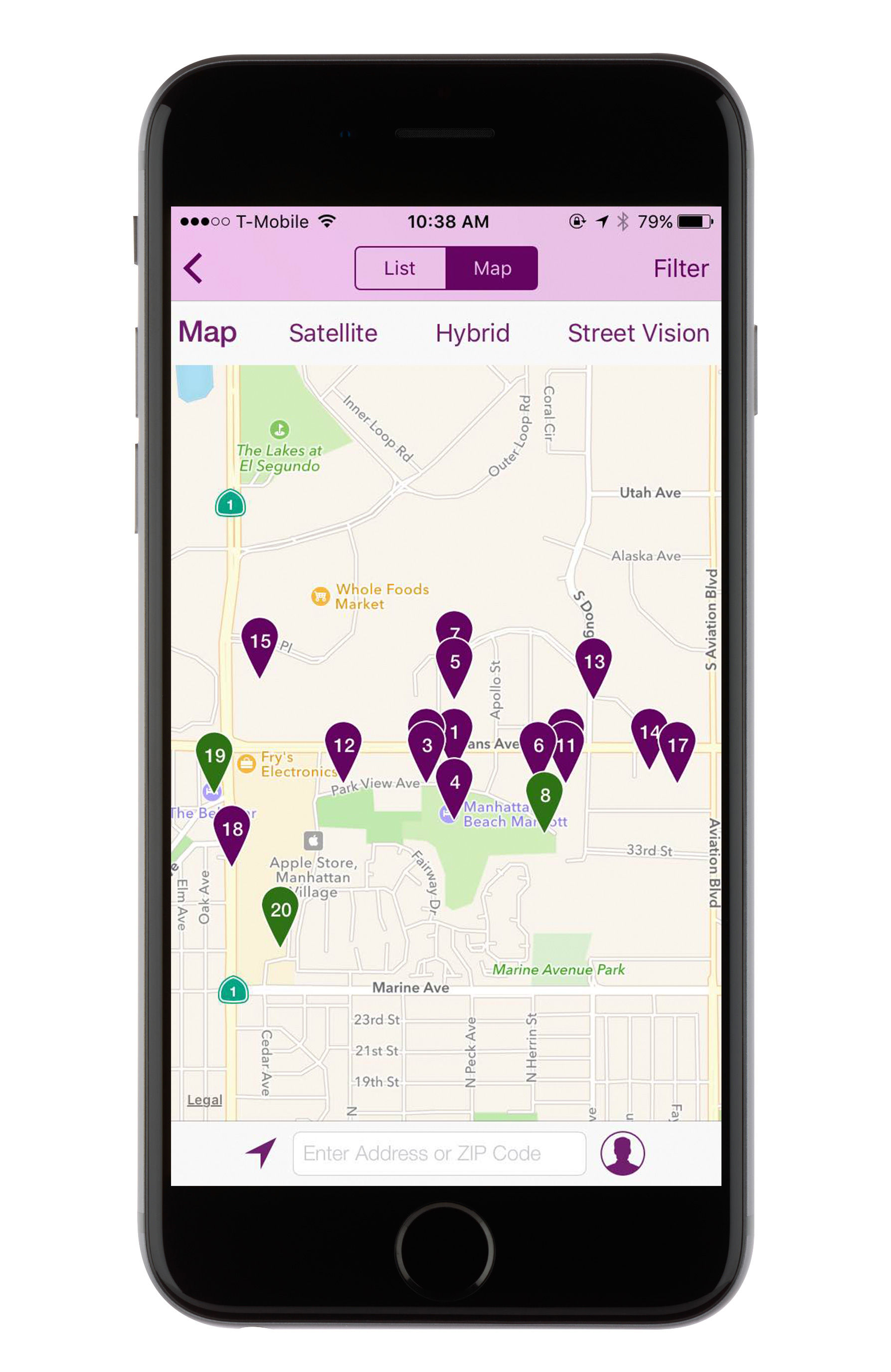

step one. Under 1041.8(c)(3)(ii)(A), a lender try permitted to supply the called for terms and conditions and you may statement with the user written down or perhaps in a good retainable mode because of the current email address in the event the consumer features agreed to located digital disclosures for the you to trend around 1041.9(a)(4) otherwise believes to get the fresh terminology and you can report of the email address when you look at the the class from an interaction started by the user in reaction on the user rights notice necessary for 1041.9(c). The following example portrays a posture in which the consumer agrees for the desired terminology and you can report by the email address immediately following affirmatively answering the fresh find: