No. Repayment can be achieved from the refinancing the reverse financial having a great old-fashioned “forward” real estate loan, otherwise through the use of most other assets.

Some opposite mortgages enjoys an origination percentage, normal settlement costs https://availableloan.net/, upfront and you may continual Financial Insurance premiums and you can a month-to-month upkeep fee. Most of the time this type of charges will be paid from the contrary financial alone, causing them to zero instantaneous load on the consumers; the costs was put in the main and you may paid down on stop, if the financing will get owed. not, there are now contrary financial items that charges greatly quicker fees together with no upfront otherwise repeated Financial Insurance premiums and you can/if any origination fees and in some cases no closing costs after all, with the exception of the latest counselling commission and you will one county particular costs which will be quite affordable.

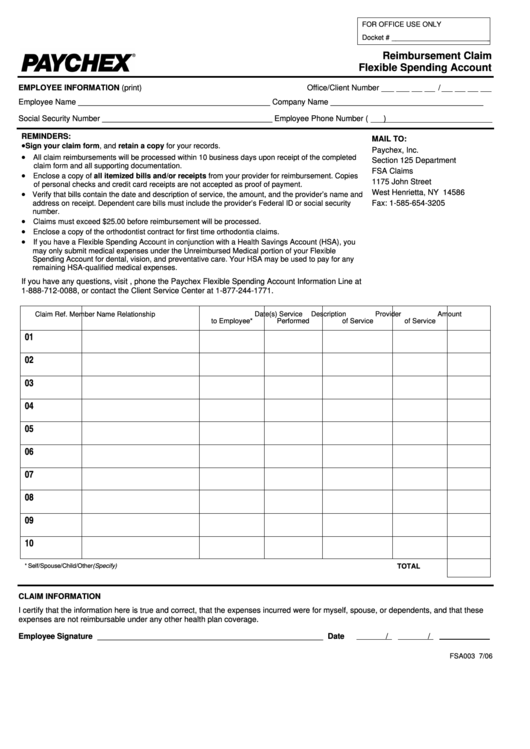

+ Exactly how much am i going to need assembled initial to pay for origination charges or other settlement costs?

One of the main benefits of a face-to-face financial is the fact you can make use of the cash obtain out of your house’s collateral (based mostly on latest data) to cover the various charges (which can range between nearly not one so you’re able to many based toward last device). The costs are only added to your loan balance. You pay them right back, along with focus, in the event the loan gets due – which is, if past thriving borrower forever movements from the household or passes away.

+ Is actually contrary financial rates fixed otherwise variable?

Opposite mortgage loans may either end up being repaired or features a changeable price that’s tied to a monetary index that will are different according to sell criteria.

+ What’s “TALC” and why must i know about they?

TALC signifies “Full Annual Financing Cost.” It brings together all can cost you out-of an other mortgage into the an individual annual average price. It may be very beneficial when you compare one type of opposite mortgage to some other. Contrary mortgages differ much more in features, positives, and you will costs. It is not most an “oranges to oranges” comparison. If you are considering an opposite home loan, make sure you pose a question to your All the California Reverse Mortgage expert otherwise specialist to explain the newest TALC cost toward certain opposite mortgage things.

+ Were there taxation outcomes? Think about my personal Public Defense and you can Medicare positives?

Given that contrary mortgages are considered financing advances and never earnings, new Internal revenue service considers the fresh continues acquired by them to be low-taxable. Also, that have a reverse home loan should not connect with the Public Shelter otherwise Medicare experts. Delight get hold of your taxation coach to assess your specific state. For individuals who discovered SSI, Medicaid, or other social guidance, their contrary real estate loan enhances are merely mentioned because the “liquid assets” for people who have them in the a merchant account after dark end away from the newest thirty day period in which you discover them. You should be careful not to allow your total liquid assets be higher than such programs make it. You should discuss the impression of a reverse financial to the government, condition or regional guidelines programs with a specialist advisor, like your neighborhood Agencies to the Ageing, their accountant or taxation attorneys. Fundamentally, a different taxation fact to consider is the fact that desire to the contrary mortgage loans isnt deductible on the income tax output before mortgage are paid down totally…in other words before the focus is basically paid.

+ Would it be true that I need to meet with an unbiased specialist before finishing my personal contrary home loan software?

Yes. It is a beneficial federally required feature of contrary financial techniques that’s available for the safeguards. The All the California Mortgage Contrary Financial pro have a tendency to counsel you on getting in touch with a separate government accepted specialist.