The newest Virtual assistant guarantees twenty-five% of one’s total amount borrowed. In this instance, the mortgage matter is actually $five-hundred,000. Ergo, they’re going to make sure $125,000 (500,000 x 0.25).

Today, you will find one or two number: the kept entitlement out of $101, because the guaranteed of the Va plus the matter you’ll must security 25% of your mortgage. Since your remaining entitlement actually equivalent to or even more than simply $125,000, you will have to afford the distinction. For this reason, about this variety of $five hundred,000 loan, you will need to make an advance payment of $23,.

Obtain the latest Griffin Gold app now!

You need an excellent COE is eligible for this new Virtual assistant financing out of a personal financial. Without one, you’re not qualified as lender need to be certain that your meet with the VA’s provider standards and also have adequate remaining entitlement so you can safe a good Va financing with zero % down.

In place of so it document, loan providers can’t agree your to own a Va financing or its positives, making it crucial to get your COE if you were to think you happen to be entitled to which work for. However, payday loan app even if you are being unsure of if you qualify, you can consult a good COE throughout the Virtual assistant to know if or not you be eligible for a great Virtual assistant financing before applying that have a loan provider.

While doing so, your COE is extremely important to possess helping lenders know the way much the latest Virtual assistant was ready to ensure for folks who standard on the mortgage. If you have already used the Virtual assistant loan, you’re needed to create a down-payment to cover new 25% make certain and you may continue to benefit from at the very least some of the many benefits of the mortgage.

That it document and establishes whether or not you only pay the fresh new Va capital percentage. Extremely borrowers will have to spend this payment, which loans the program helping almost every other qualified consumers safe a beneficial Virtual assistant financing.

Ways to get a certificate away from Eligibility

Obtaining your Virtual assistant mortgage Certificate out of Eligibility is essential if you must take-out good Virtual assistant financing. Once you’ve acquired your COE, you could start looking for a house thereby applying for a great Virtual assistant loan. Obviously, it is important to observe that their COE cannot make sure mortgage acceptance. Alternatively, it tells lenders your qualified to receive brand new Va financing as well as how the majority of your entitlement you really have left.

There are some ways to get the COE, and lots of are smaller as opposed to others. Particularly, for many who consult your own COE myself with the Va, it can take as much as six weeks to get it from the mail. not, you can find other options, which includes the second:

Speak with the financial

One of many most effective ways to get your COE getting acknowledged to have a great Virtual assistant mortgage is to ask your financial. VA-recognized lenders can frequently availableness an online system so you can rapidly receive your COE. Normally, this is your best option if you have already setup a deal into the property and want to streamline the application form process.

Demand COE online

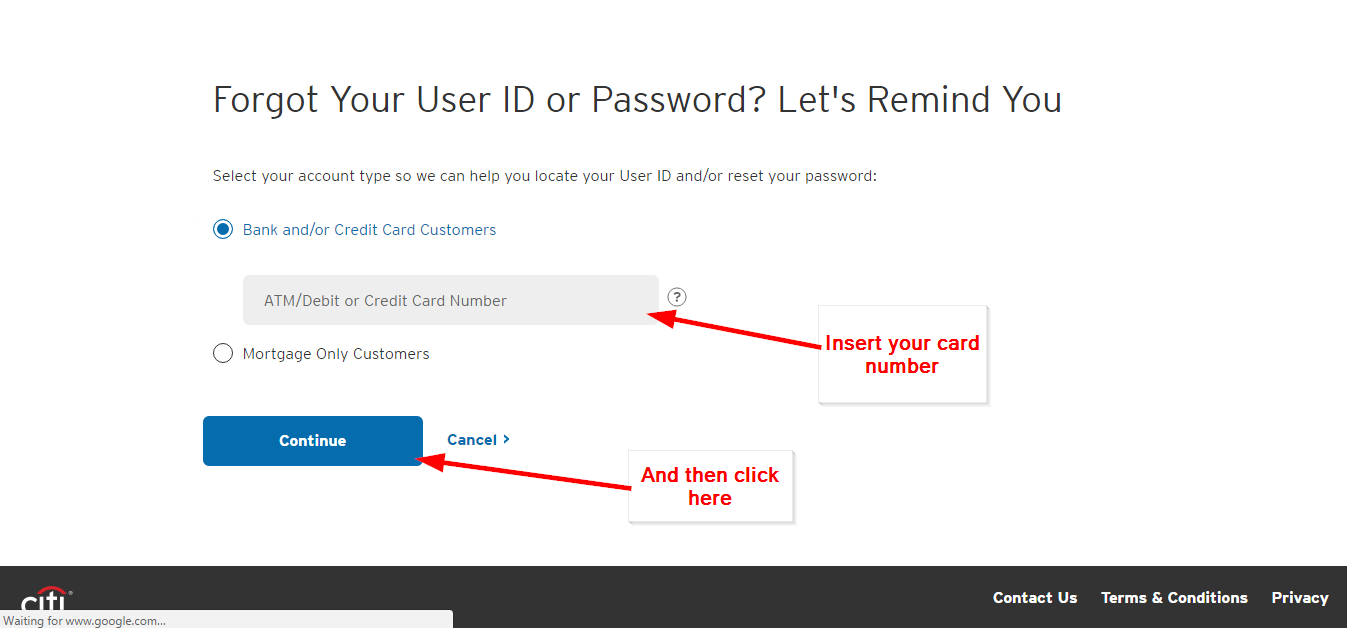

The brand new Virtual assistant makes you consult your COE on the web using the eBenefits portal . Rather than delivering a lender together with your Social Safeguards matter and you can other private information, you can simply sign in otherwise create a different sort of membership.

Get the COE by send

An alternative choice would be to printing out of Function twenty-six-1880 and post it towards the Virtual assistant. Although not, for folks who consult your own COE because of the post, it takes as much as six weeks otherwise extended, depending on your position. For this reason, this is basically the minimum effective strategy and most likely a bad alternative if you have already lay a deal during the for the a property and wish to move on with a sleek software process.

Alternatively, you could potentially like this one if you are considering to shop for a home and want to see when you find yourself qualified. On top of that, you will want a unique COE every time you use your Va mortgage, so if you’ve currently utilized your loan, you need someone else before applying for the next mortgage.