5/step 1 Changeable Price Mortgage

An effective 5/1 varying speed home loan (ARM) otherwise 5-year Sleeve is actually a mortgage where 5 is the long-time your own initially interest rate will continue to be fixed. The 1 means how many times your own interest rate have a tendency to to evolve following the 1st five-season period concludes. The most popular repaired episodes are step 3, 5, eight, and you may 10 years and you will 1, is among the most well-known changes several months. It is critical to carefully investigate offer and get concerns if the you’re interested in a supply.

Ability-to-pay off signal

The ability-to-pay back code ‘s the practical and good faith dedication extremely financial loan providers must make that you are able to invest back the borrowed funds.

Changeable Speed Financial (ARM)

A changeable rate mortgage (ARM) is a kind of loan wherein the interest rate can also be transform, usually in relation to a collection rate of interest. Your payment will go upwards or down with respect to the loan’s introductory months, price limits, together with directory rate of interest. Which have an arm, the speed and monthly payment may start away lower than to possess a predetermined-rates financial, but the interest and you may monthly payment can increase dramatically.

Amortization

Amortization setting paying off financing that have regular costs through the years, and so the matter you owe ortize, however mortgages do not completely amortize, and therefore you’ll however owe money once and also make every one of your payments.

Certain home loans make it repayments that cover only the amount of appeal owed, otherwise a price lower than the attention due. In the event that costs was below the level of desire owed for every single week, the borrowed funds harmony will grow in place of ortization. Other mortgage applications that don’t amortize fully inside loan may require a big, lump sum balloon fee at the end of the borrowed funds label.

Number financed

It indicates how much money youre credit regarding the lender, without every initial charge the financial institution was charging you.

Yearly earnings

Annual money are a factor in a mortgage software and you can fundamentally makes reference to your full received, pre-taxation earnings more than per year. Yearly money include income of complete-big date or region-go out functions, self-a career, information, earnings, overtime, bonuses, and other supplies. A loan provider use information about the yearly earnings as well as your current month-to-month expenses to determine if you possess the capacity to pay back the borrowed funds.

Whether a lender commonly trust in a specific source of income or number about your for a loan can occasionally rely on if you could fairly assume the income to keep.

Apr (APR)

An apr (APR) is a wider measure of the cost of borrowing money than the pace. The fresh new Annual percentage rate reflects the interest rate, one items, mortgage broker charge, and other charge you shell out to obtain the mortgage. Therefore, your own Apr is often higher than the interest.

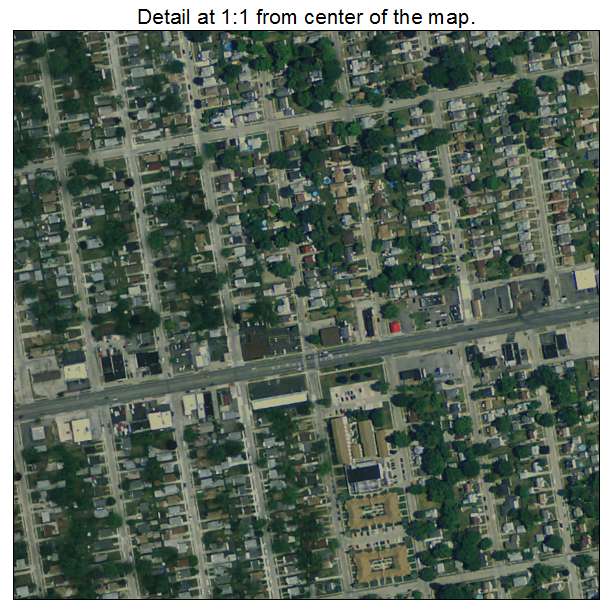

personal installment loans Sumter SC

Appraisal payment

An appraisal payment is the cost of a home assessment out-of property you intend to shop for otherwise already very own. Family appraisals provide a separate evaluation of worth of the brand new possessions. More often than not, your selection of the newest appraiser and people associated can cost you is right up on the financial.

Automatic fee

Automated costs enables you to set up recurring mortgage payments courtesy your financial. Automated repayments would be a convenient solution to make sure that you will be making your instalments punctually.

Balloon mortgage

For mortgages, a good balloon loan ensures that the borrowed funds features a bigger-than-typical, one-big date percentage, generally at the end of the borrowed funds title. This-time payment is called an effective balloon fee, and is higher than your most other repayments, often a lot higher. If you fail to spend the money for balloon count, you may have to re-finance, promote your residence, or deal with foreclosures.