100% capital mortgage in the New york & Pennsylvania seems to be an interest that comes right up much. A couple of times as i in the morning away probably societal situations, the latest dialogue transforms to your financial business and all of brand new 50 % of recommendations your average man or woman enjoys heard from mass media.

Some body always appear if you ask me and you may opinion on all the risky mortgage loans that were done and the reasons for having this new sub-best meltdown during the New york & Pennsylvania. I always hear I can’t believe they certainly were undertaking 100% funding lenders!

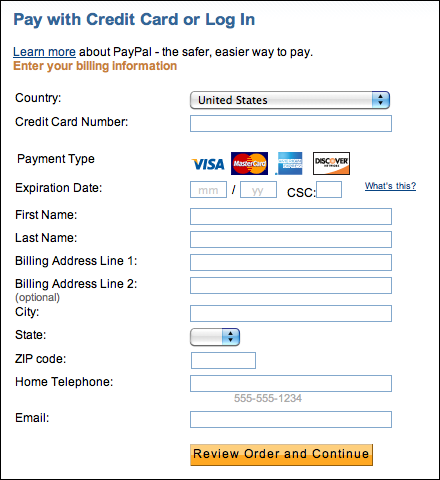

For more information telephone call (833) 844-0141 today, request a totally free Mortgage Quotation otherwise prequalify to discover more regarding available financial options.

100% Financial support Mortgage inside Ny & Pennsylvania: Mortgages That want Absolutely nothing Money Down

Right now, 100% financing financial within the Ny & Pennsylvania is not an extremely high-risk financing to the lenders.The latest loans that were done over the past a couple of years on 100% financial support mortgage loans was indeed risky because they was in fact along with Zero Income confirmed. The combination of them dos things are what generated those individuals money thus risky. Home financing is just as an effective since function of your debtor to help you re also-spend the money for loan. The funds one went crappy, was indeed the result of very speculative dealers who had been entering home no currency down, with the expectation out-of flipping them getting a return. When the market became, such individuals was leftover carrying the new scorching potato and just decrease all of them. They couldn’t manage to result in the costs and let the residential property check out foreclosure.

100% Resource Mortgage brokers within the Ny & Pennsylvania

Today, 75% of all the my personal the brand new purchasers make down costs between 0-3% down. These fund have quite attractive costs but do require a good credit score and you may full income verification. If you were leasing for $1500 four weeks for more than three years and also you you are going to pick property to have state $1800 per month why should you? Lenders have the in an identical way.

Fundamentally, 100% resource mortgage loans was in fact high-risk money, because if the brand new debtor don’t pay, the lenders thought they’d recover 80% of the financing away from a foreclosures income. (this 80% draw ‘s the mendoza type of mortgages, baseball reference).

Yet not, for the today’s 100% capital mortgage products in New york & Pennsylvania, the fresh 80-100% guarantee is actually covered by making use of PMI (private mortgage insurance policies). The new debtor pays the cost of plans one to makes sure the lender that when the loans goes bad, the latest PMI organization will take care of specific part of the an excellent financing harmony. The financial institution can now foreclose, recoup 80% in the sale and make a claim from the PMI company so you’re able to counterbalance it is losses. Just what a wonderful business we live-in!

No matter what, the risk of virtually any mortgage is set by ability away from one or entity so you can lso are-spend the money for loan therefore the security payday loan Graysville one to protects the loan in the event the for some reason the mortgage is not repaid. Today’s 100% fund are increasingly being checked on capacity to lso are-shell out and tend to be being insured by applying PMI. There is no reason loan providers shouldn’t be offering such loans. In fact, he is available on better conditions than just had been up to 2 years back.

Don’t be swayed about what you pay attention to regarding the news, usually the information is incorrect or becoming informed since the partial insights. Demand a mortgage elite and you can search. While the the next time you are on a cocktail party and listen to I can’t believe they were providing 100% resource lenders into the Nyc & Pennsylvania, clean it well as the yet another misinformed 10 o’clock information watcher.